04.

Use Cases

Manage risk & liquidity on any ERC20 tokens you own.

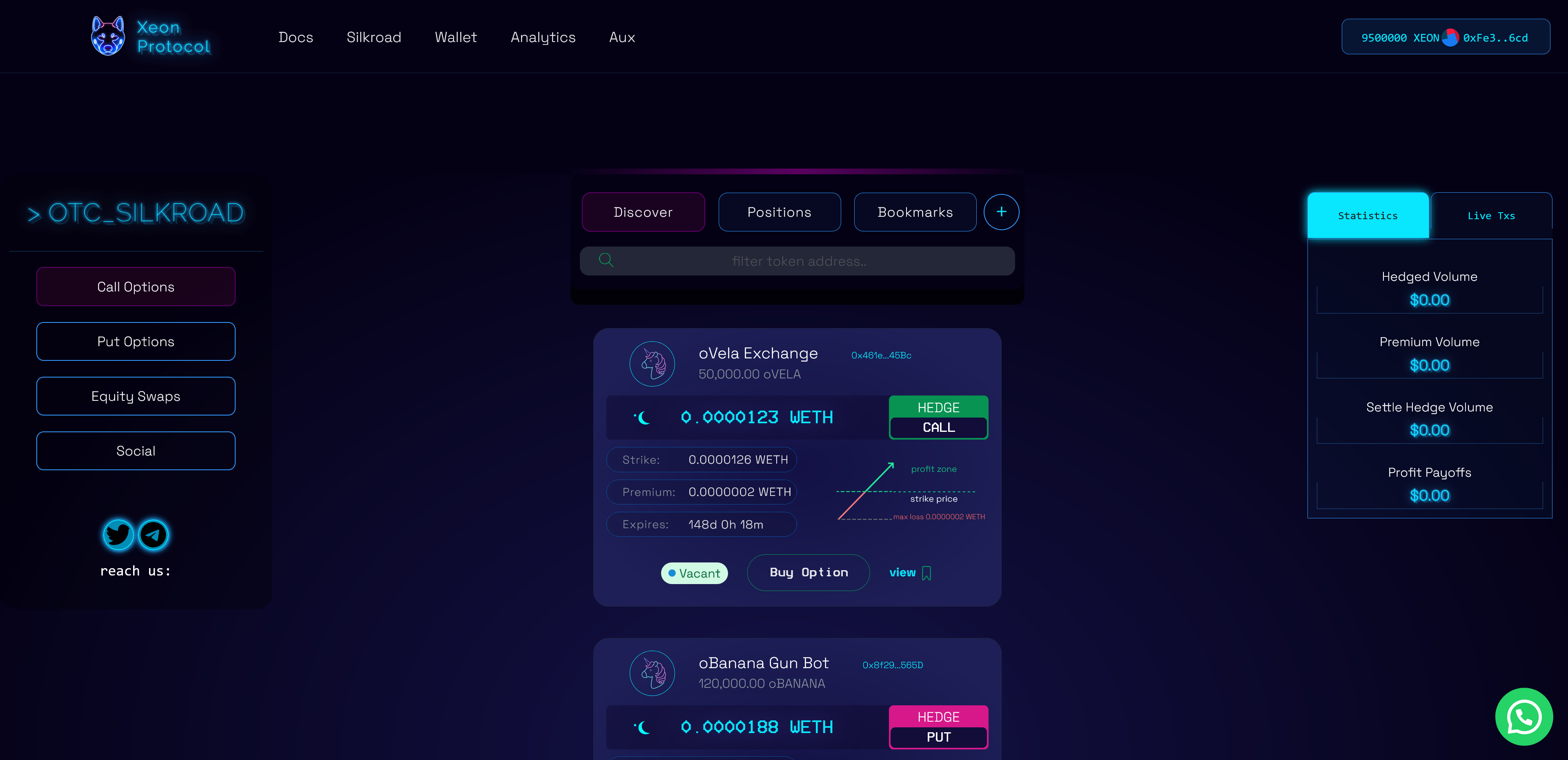

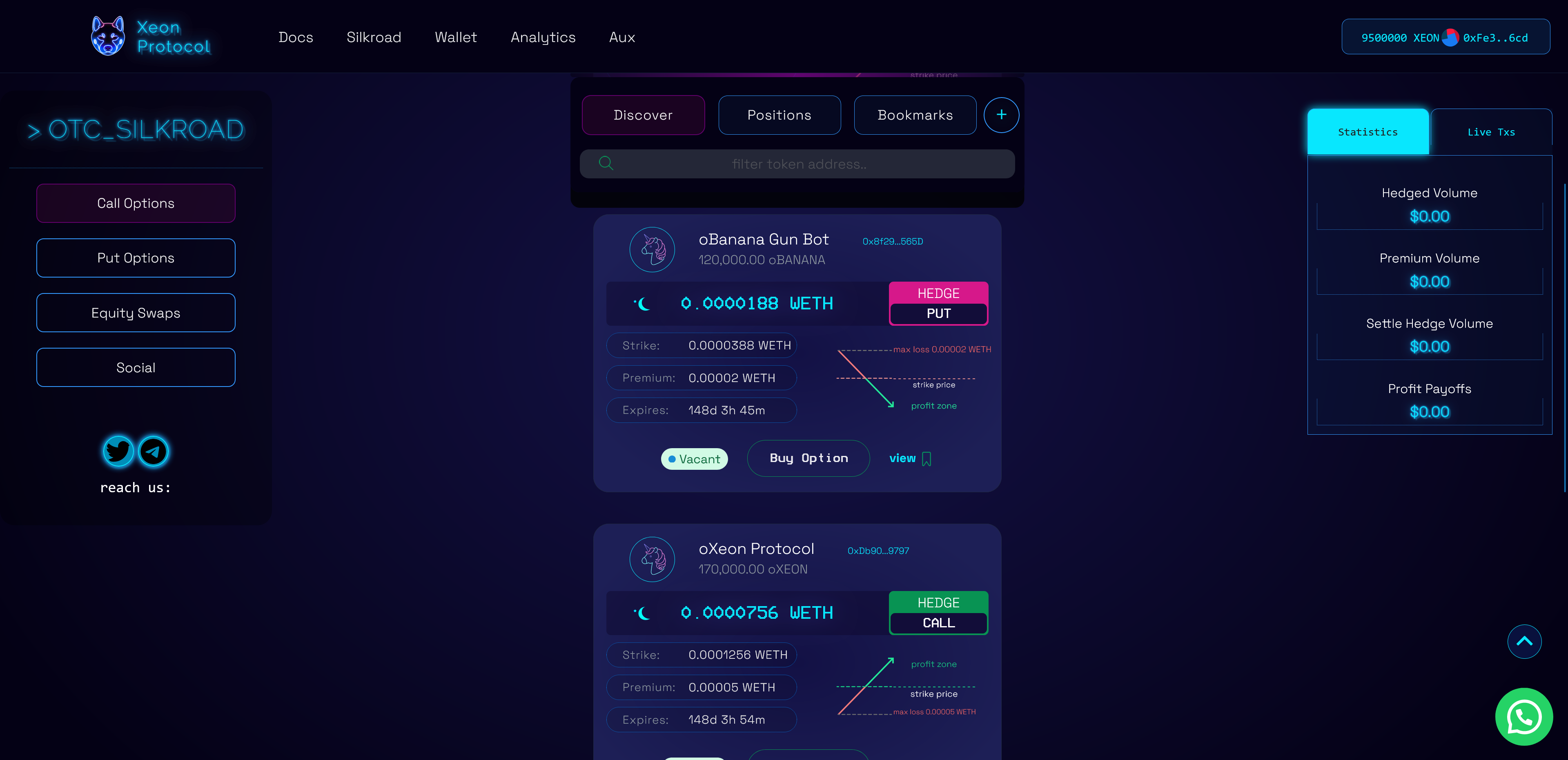

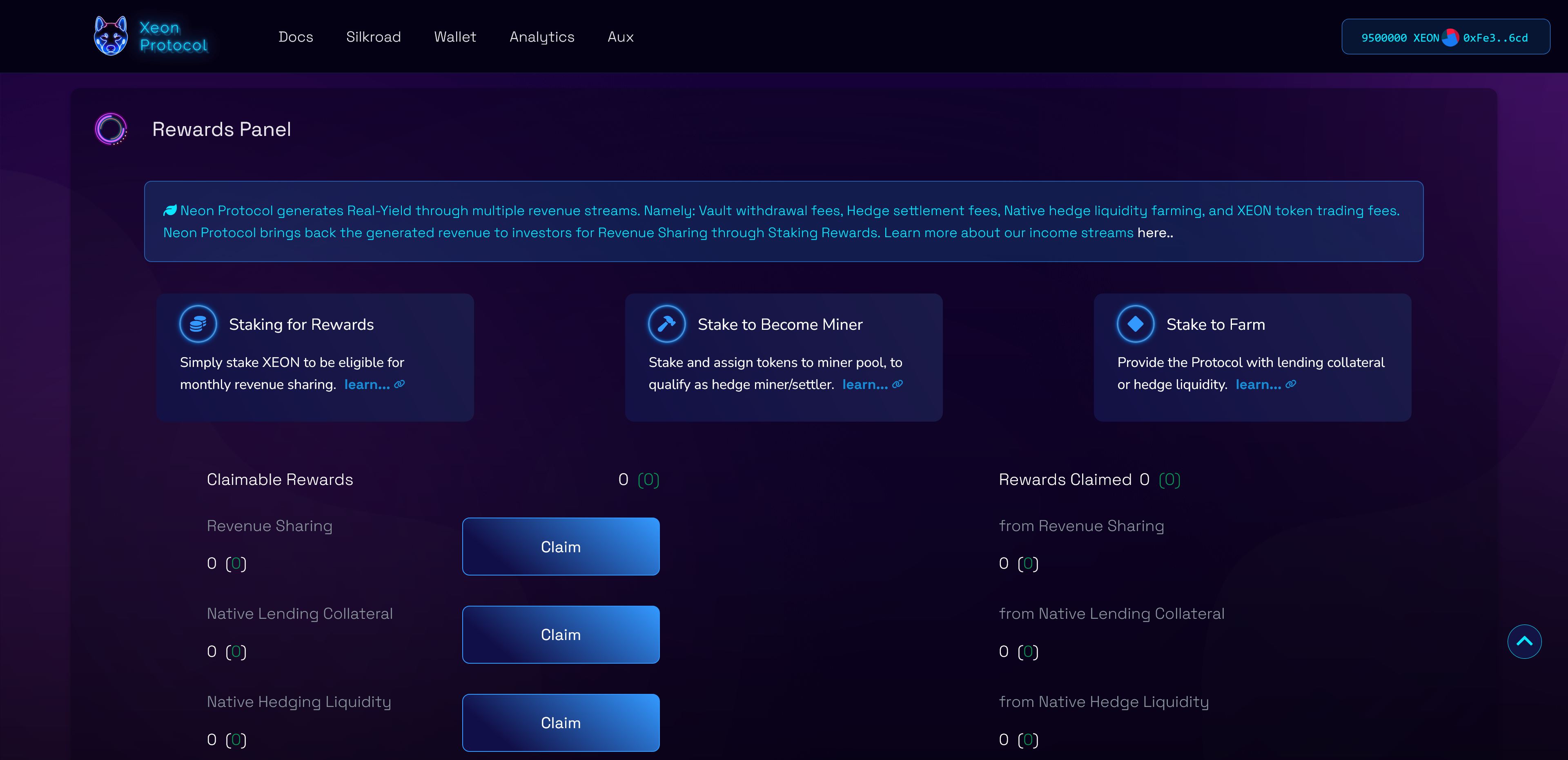

This platform enables you to unlock liquidity and manage risk on any ERC20 tokens you own, without selling.

Xeon Protocol helps you manage your ERC20s:

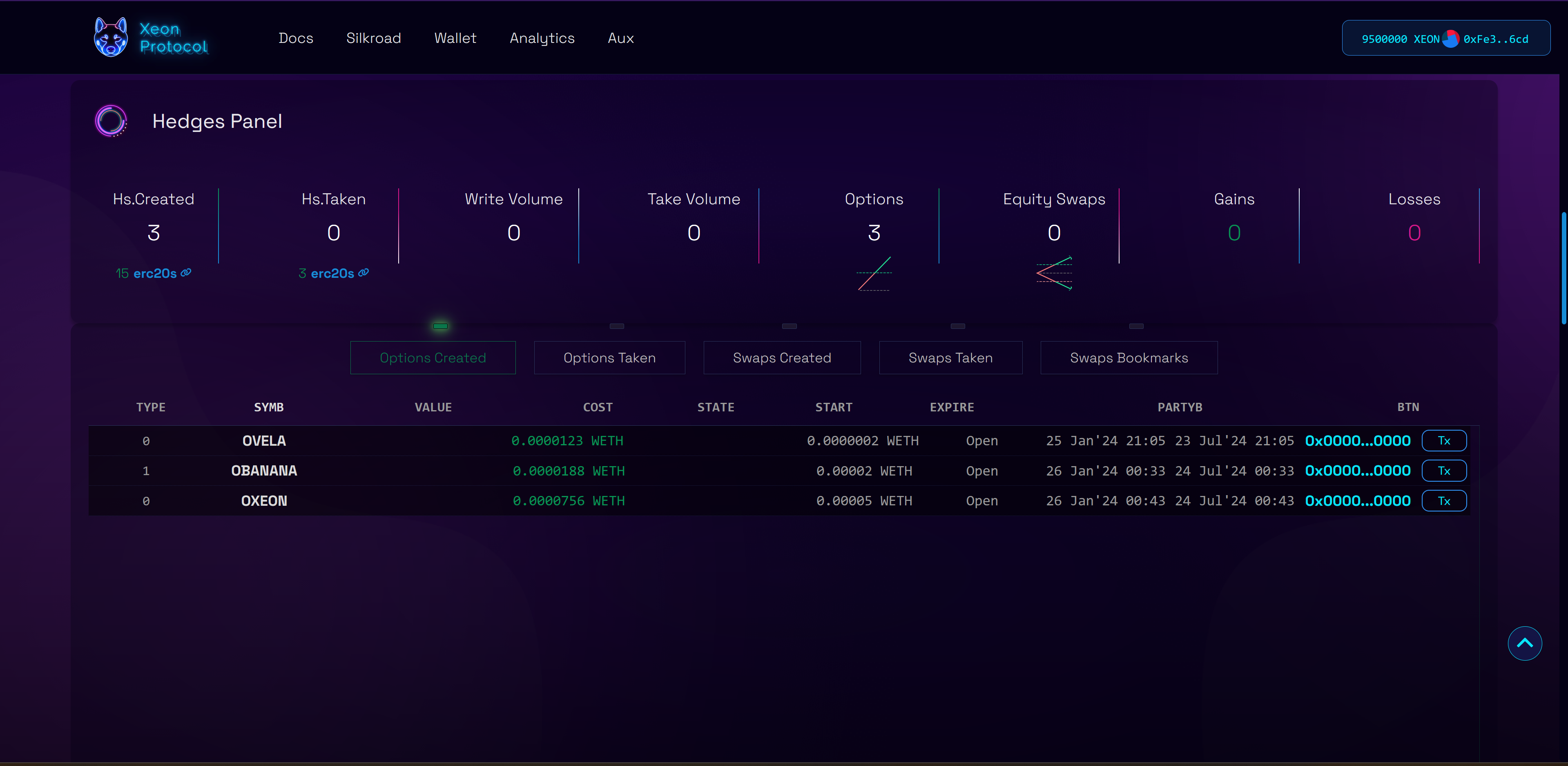

1. Hedge Risk - cover your ERC20 tokens against price drops.

2. Speculate - on future token prices, to accumulate more.

3. Leverage Capital - buyers are paying for higher exposure.

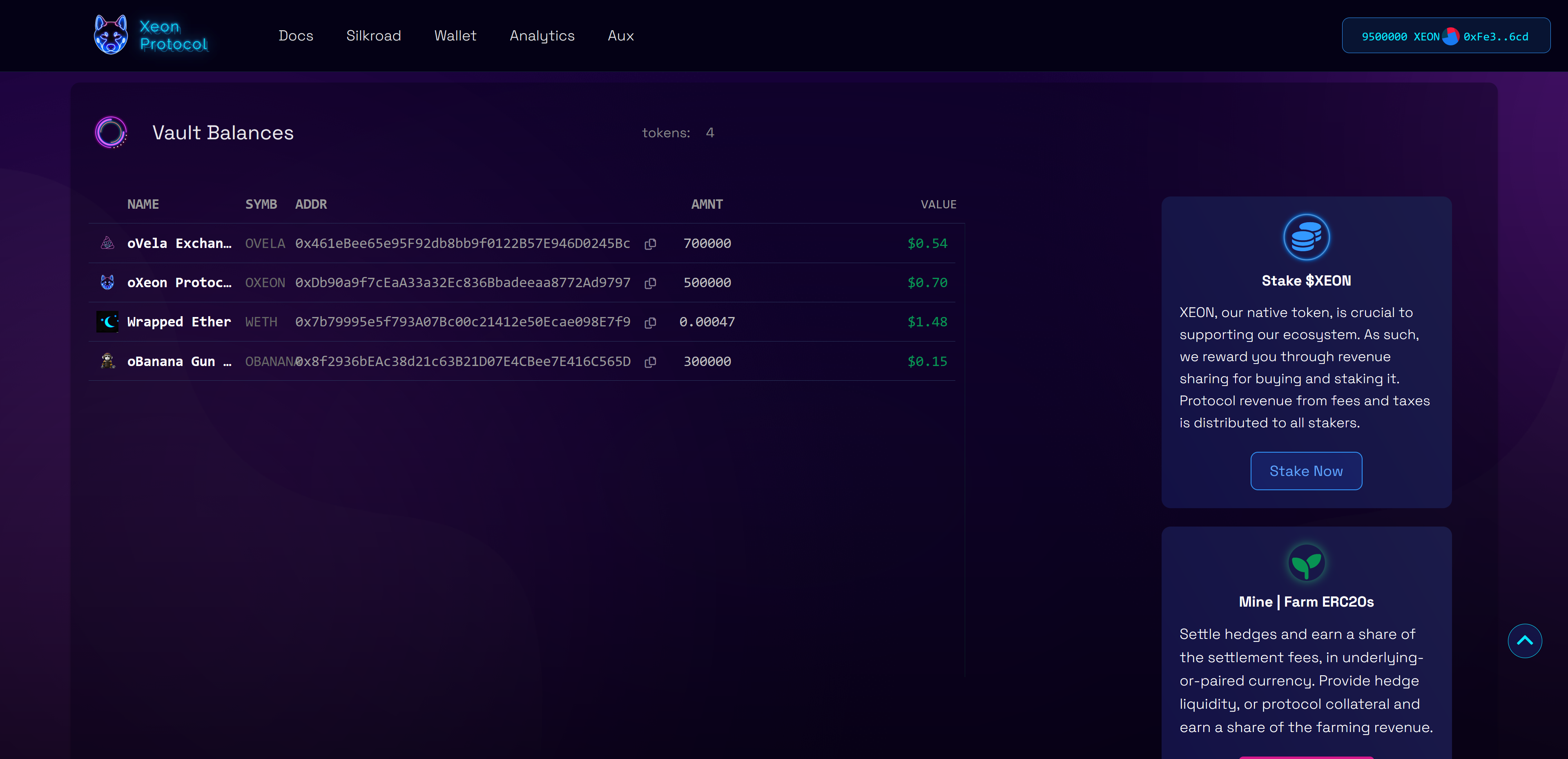

4. Unlock Liquidity - get a loan from your ERC20 token holdings. Withdraw the liquidity to buy more tokens.

Scenarios X - imagine this

Factors

-AI SEASON IS TRENDING

-AI COINS ARE PUMPING 20X

-NEW COIN LAUNCHES - $NEWAI

Scenario Simulation...

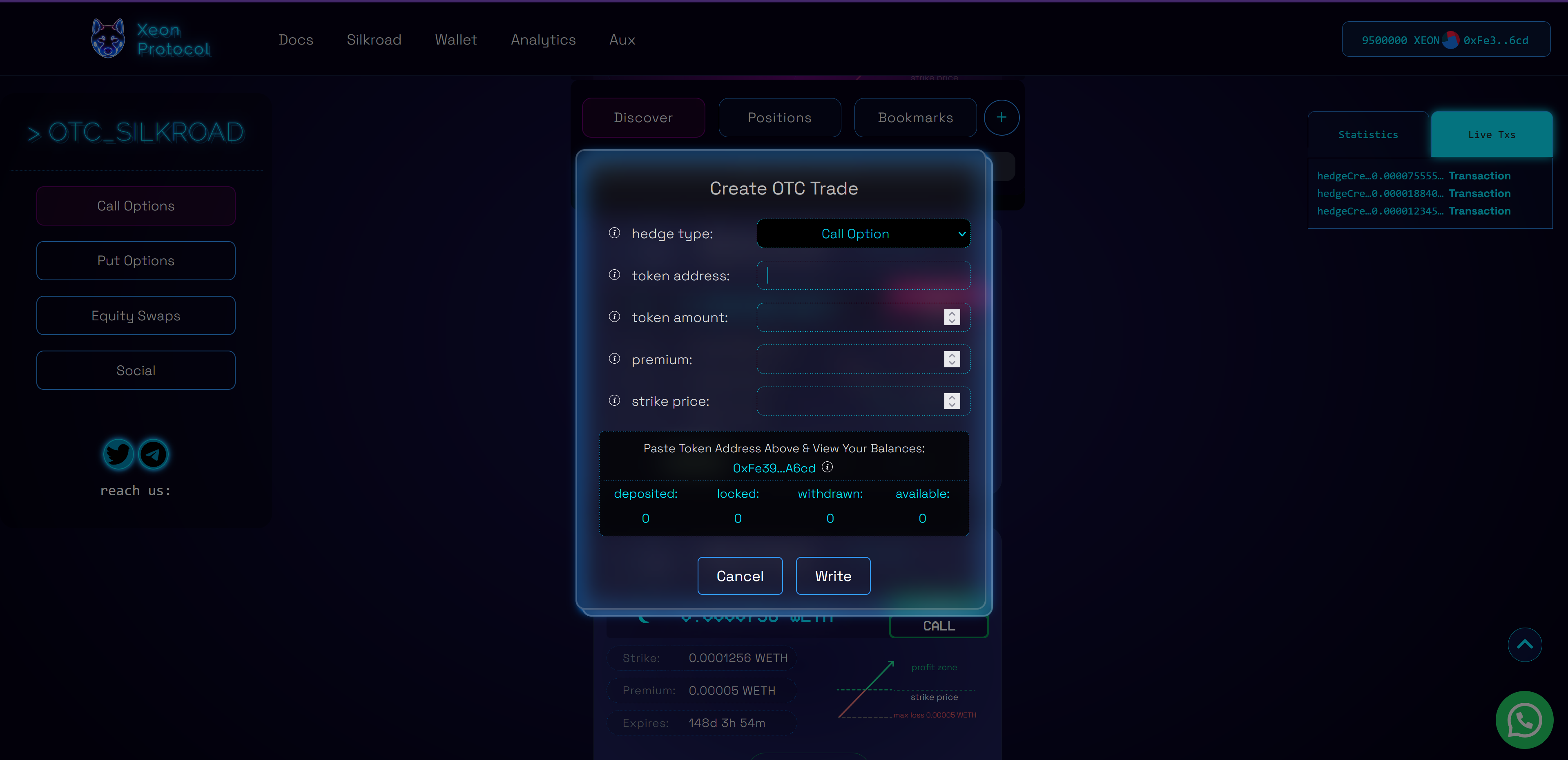

1. Capo sees 20x opportunity in $NEWAI

2. Buys $NEWAI tokens worth $200

3. Capo creates a call option using the deposited tokens: duration 6 months and charges $400 as cost, with a strike price 5X away from current price.

4. DegenX sees the OTC deal from Capo. He figures AI tokens will 20x in 6 months time since its a bull season. Even if the cost is double the current value of the $NEWAI bags, the strike price which is just 5X away can leave room for profit. DegenX sees a good chance to pocket all gains when the token price for $NEWAI goes above the strike price.

5. DegenX pays $400 to Capo for the call option on the $NEWAI bags. Capo receives that money, withdraws and uses it as extra liquidity to buy more $NEWAI tokens on Uniswap.

6. In 6 months time, $NEWAI is now 30X. The bags are now worth $6000. DegenX paid only $400 for the call option, all gains from the time the strike price was crossed, to current price, belong to DegenX. Capo only gets the difference and the $400 cost paid when hedge was bought.

7. Capo on the other hand had received $400 when his call option was bought, and used it as extra liquidity to buy more $NEWAI tokens. That $400 also increased in value 30X.

Win -win for DegenX and Capo.